Faecal Sludge Management project

READ MORE

"গাছ লাগিয়ে যত্ন করি, সুস্থ প্রজন্মের দেশ গড়ি" ৫ জুন ২০২৩ বিশ্ব পরিবেশ দিবসে এই শ্লোগানকে সামনে নিয়ে সংস্থার ঢাকা অফিসের উদ্যোগে রাজধানীতে বৃক্ষরোপণ কর্মসূচির সূচনা করা হয়। আজকে শ্যামলী-রিং রোডে পলাশ, কৃষ্ণচুড়াসহ আরো বেশকিছু ঔষুধী বৃক্ষরোপণ করা হয়। বৃক্ষরোপণের কোন বিকল্প নাই।

Read More

সভাটি সঞ্চালনা করেন এলাইন্স এর সমন্বয়ক জনাব আবু নাসের অনীক। সভায় সশরীরে উপস্থিত ছিলেন এলাইন্স এর কো-চেয়ারম্যান,সাভার পৌরসভার মেয়র জনাব হাজী আব্দুল গনি, সাধারণ সম্পাদক, ধামরাই পৌরসভার মেয়র জনাব গোলাম কবির, মনোহরদি পৌরসভার মেয়র জনাব আমিনুর রশিদ সুজন। ভার্চুয়ালি যুক্ত হয়ে আলোচনায় অংশগ্রহণ করেন রংপুর সিটি কর্পোরেশনের সম্মানিত মেয়র জনাব মোস্তাফিজার রহমান, ঠাকুরগাঁও পৌরসভার মেয়র জনাব আঞ্জুমানা বেগম, সুন্দরগঞ্জ পৌরসভার মেয়র জনাব আনোয়ার রেজা, হরিনাকুন্ডু পৌরসভার মেয়র জনাব ফারুক হোসেন, মহেশখালি পৌরসভার মেয়র জনাব মকছুদ মিয়া আলোচনায় অংশগ্রহণ করেন।

Read More

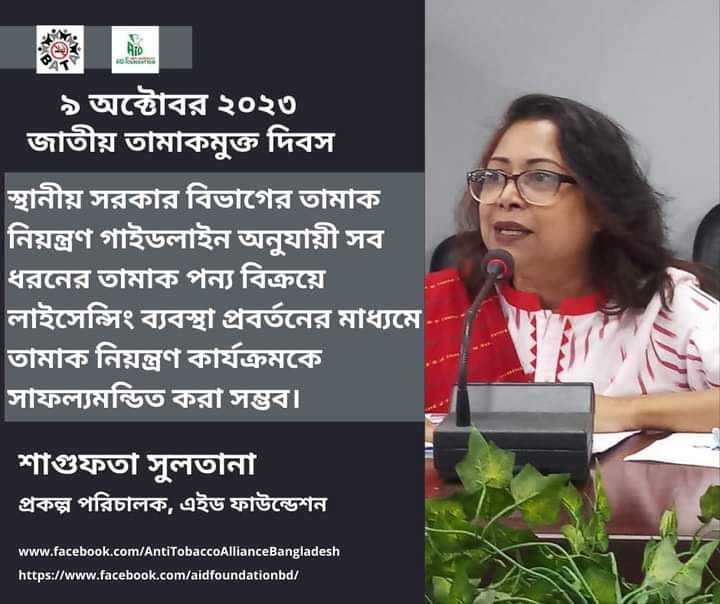

সভায় ধূমপান ও তামাকজাত দ্রব্য ব্যবহার (নিয়ন্ত্রণ) আইন ২০০৫ (সংশোধিত) আইনটির সংশোধনী প্রস্তাবনার উপর আলোচনা হয়। একই সাথে আগামী বাজেটে তামাকজাত দ্রব্যের উপর সুনির্দিষ্ট করারোপের বিষয়ে তার সমর্থন প্রত্যাশা করা হলে তিনি জানান, তামাক নিয়ন্ত্রণের বিষয়ে যেকোন ধরণের পদক্ষেপের সাথে উনি সংহতি প্রকাশ করছেন।

Read More

Today 29th March 2023 attend The National Consultation on Child-focused UPR Stakeholders' Report.

Today 11th March, 2023 a team comprised with 25 members from Gazipur City Corporation visited AID Foundation's FSM project. After visit the team meet with AID Foundations senior staff and hold a discussion meeting on FSM Project. The team express their satisfaction after discussing on project.

The mayors at a two-day conference have taken the decision that strong steps will be taken to implement the Smoking and Tobacco Products Usage (Control) (Amendment) Act, 2013; and Tobacco Control Implementation Guidelines for Local Government Institutes in order to prevent the tobacco-related diseases and deaths. The two-day conference ‘Bangladesh Mayors’ Summit for Tobacco Control and Disease Prevention’ was held in Cox’s Bazar. The summit began on 23 September Friday and ended on Saturday (September 24, 2022).

Read More

এইড ফাউন্ডেশন কর্তৃক বাস্তবায়িত “ Improved Education Outcomes For Deaf children In Bangladesh (IEO-DCB )” প্রকল্পের আওতায় আন্তর্জাতিক ইশারাভাষা দিবস ও শ্রবণ প্রতিবন্ধী সপ্তাহ, ২০১৯ উদ্যাপন উপলক্ষে সপ্তাহ ব্যাপী বিভিন্ন অনুষ্ঠানের আয়োজন করা হয়। ০৮ আশ্বিন ১৪২৬ বঙ্গাব্দ (২৩ সেপ্টেম্বর ২০১৯ খ্রিস্টাব্দ) সকাল ১০.০০ টায় এক বণার্ঢ্য শোভাযাত্রা ও আলোচনা সভার মাধ্যমে অনুষ্ঠানের সূচনা হয়। পরবর্তীতে ইশারা ভাষা প্রতিযোগিতা, ক্রীড়া প্রতিযোগিতা, শিশু সুরক্ষা সেশন, ইশারা ভাষা সেশন এবং আজ ১৪ আশ্বিন ১৪২৬ বঙ্গাব্দ (২৯ সেপ্টেম্বর ২০১৯ খ্রিস্টাব্দ) সকাল ১০.০০ টায় ঝিনাইদহ প্রেসক্লাবে প্রতিবন্ধী নারীদের সামাজিক নিরাপত্তা এবং “প্রতিবন্ধী ব্যক্তির অধিকার ও সুরক্ষা আইন-২০১৩” সফল ভাবে বাস্তবায়নের দাবিতে সাংবাদিক সম্মেলন এবং মানব বন্ধন কর্মসূচির মাধ্যমে আন্তর্জাতিক ইশারাভাষা দিবস ও শ্রবণ প্রতিবন্ধী সপ্তাহ-২০১৯ উদযাপন সমাপ্ত হয়।

AID Foundation received “Bangladesh Leadership Awards 2019” on 8th September, 2019 at Pan Pacific Sonar Goan, on wards which is only the NGO in Bangladesh to received this award.

Read More

Faecal Sludge Management project

READ MORE

Combating Gender-Based Violence Project (CGBV)

READ MORE

Promotion of Sustainable Agriculture Practice (PSAP) with less irrigation water

READ MORE

AID Building Resilience of Returning Migrants from the Andaman Sea through Economic Reintegration and Community Empowerment Project–DIBP

READ MORE

AID Tobacco Control Project -PROTECT

READ MORE

AID Disable Children Rehabilitation program-DCRP

READ MORE

Copyright - 2023. All rights reserved By AID Foundation.